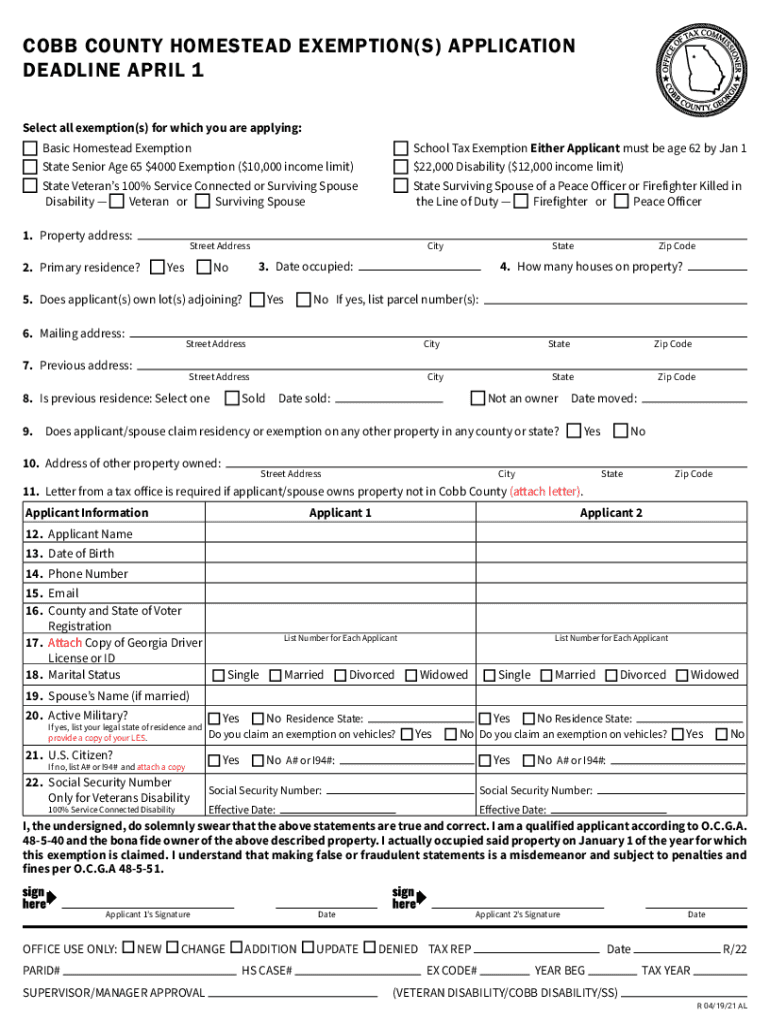

Fulton County Homestead Exemption Application 2025 - Homestead Exemption Complete with ease signNow, The home must be your primary residence. Phone services have been re. Cobb Homestead Exemptions 20252025 Form Fill Out and Sign Printable, You are able to make homestead exemption filings as well as business, aircraft and marine personal property returns using our online filing portal. Qualifying period for county offices candidates:

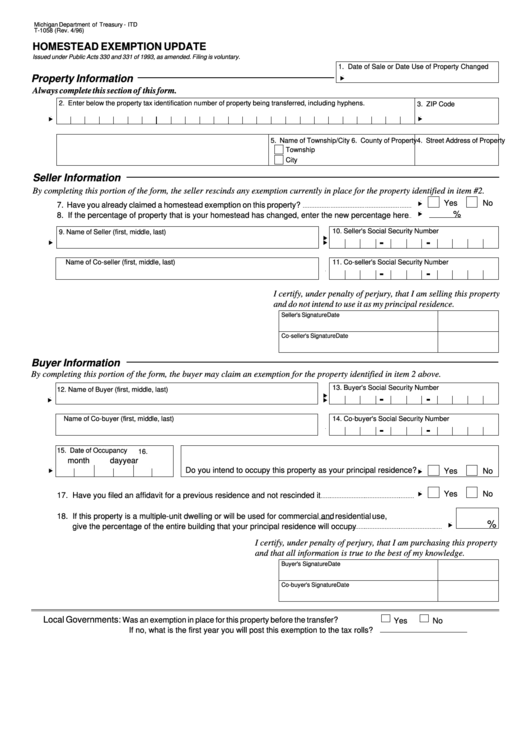

Homestead Exemption Complete with ease signNow, The home must be your primary residence. Phone services have been re.

The deadline to apply for is april 1 to receive the exemption for that tax year.

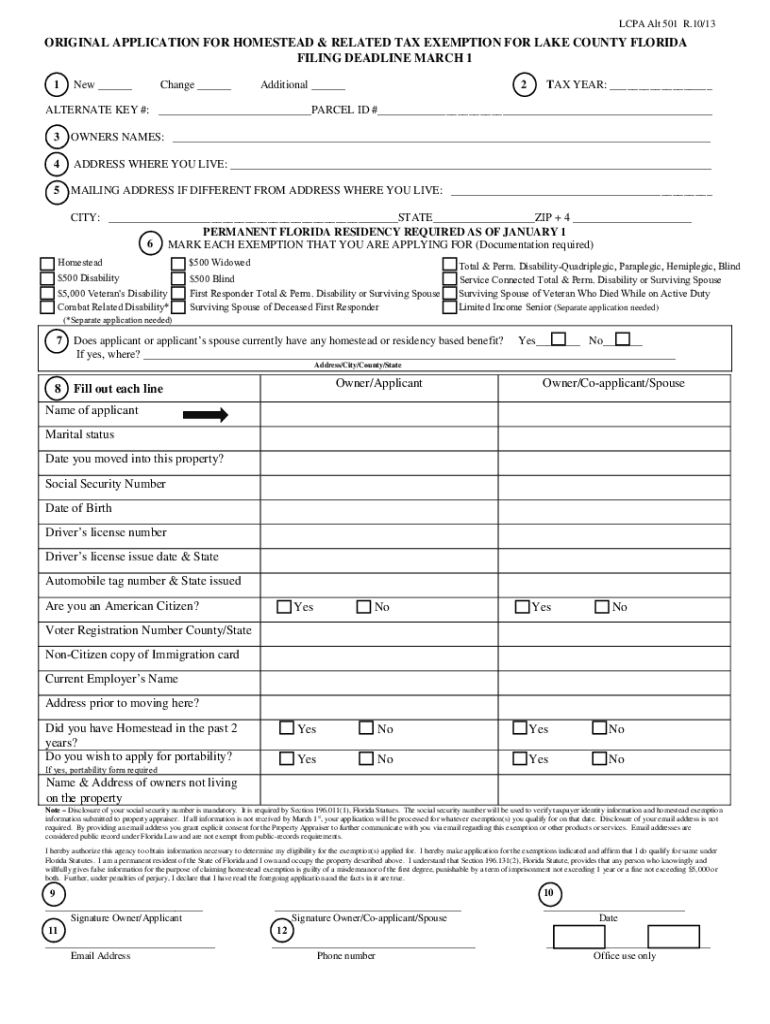

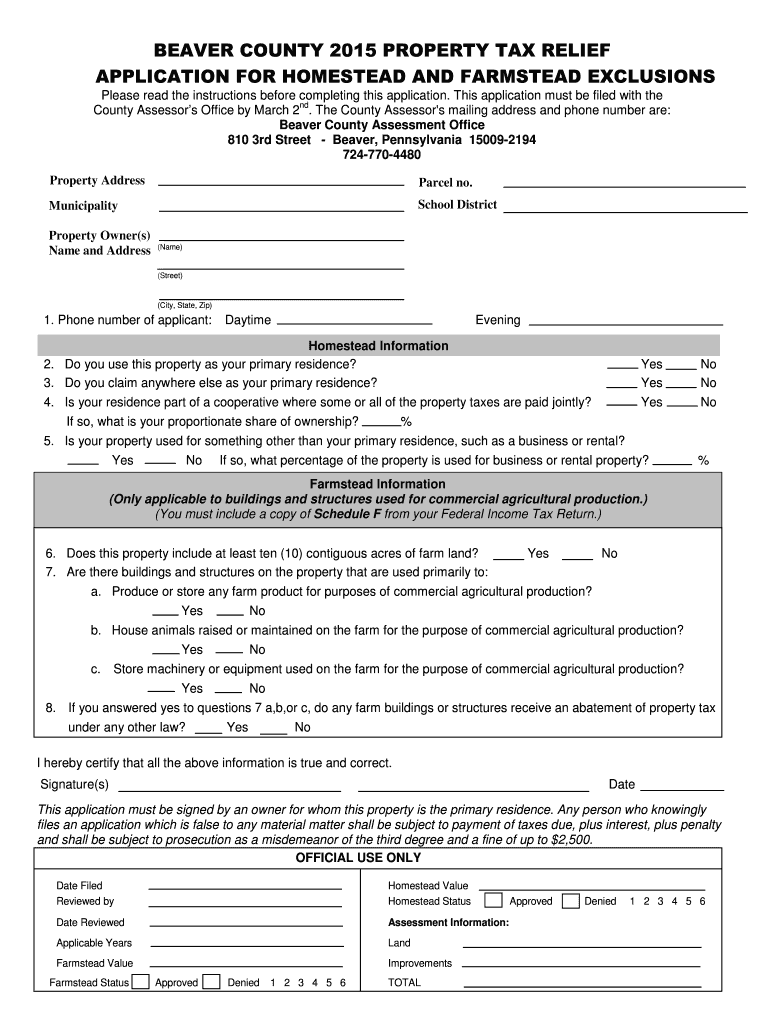

Beaver county homestead exemption Fill out & sign online DocHub, You are able to make homestead exemption filings as well as business, aircraft and marine personal property returns using our online filing portal. • 2025 marine personal property return.

If you own and live in a house in fulton county, you may qualify for homestead.

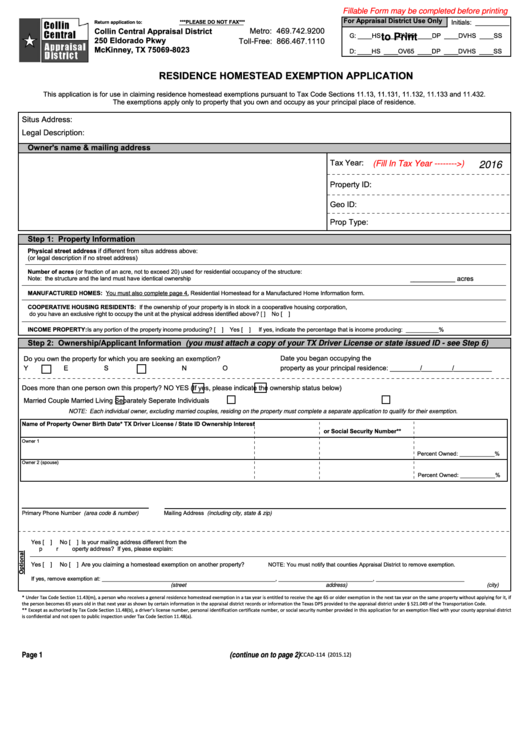

Fillable Original Application For Homestead And Related Tax Exemptions, For the basic exemption in the city of atlanta and fulton county, it is $30,000 while the statewide school tax exemption is $10,000. If you own and live in a house in fulton county, you may qualify for homestead.

What is classstrata in homestead exemption form Fill out & sign online, Real property and manufactured or mobile homes: Dekalb homeowners receive an assessment exemption of $12,500 for school taxes and $10,000 for county levies (except bonds).

Fulton County Homestead Exemption Application 2025. The home must be your primary residence. Phone services have been re.

Homestead exemption virginia Fill out & sign online DocHub, • 2025 freeport exemption application. The deadline to apply for is april 1 to receive the exemption for that tax year.

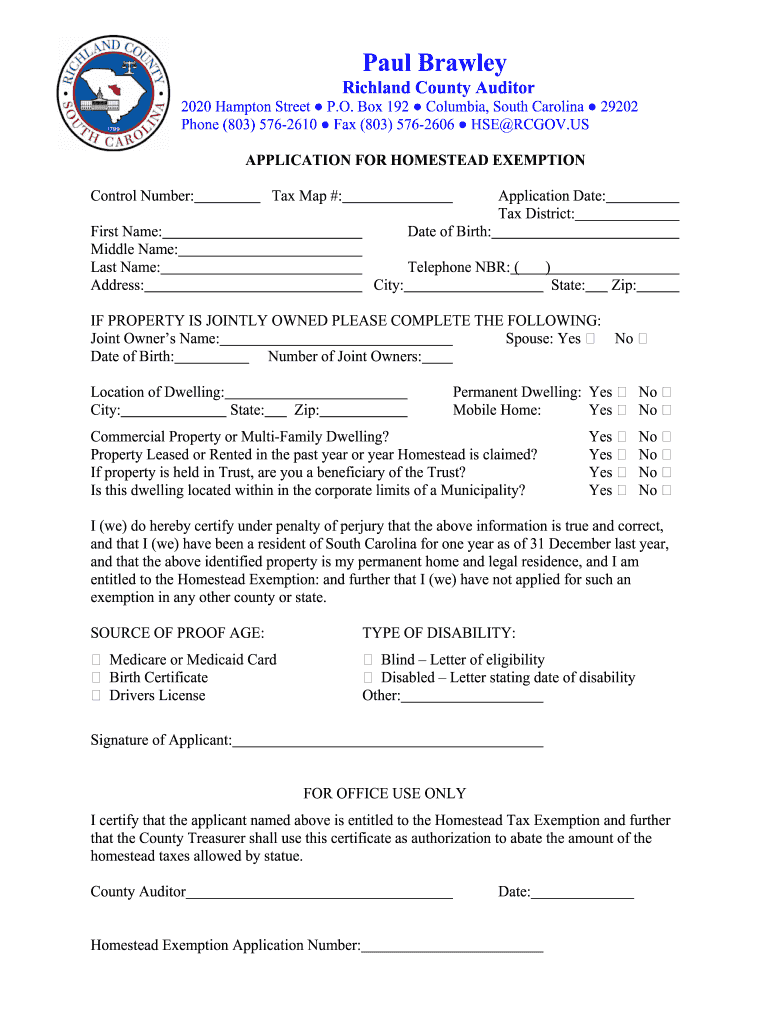

GA Application For Basic Homestead Exemption Fulton County 2025, The home must be your primary residence. Fulton county homeowners who are over age 65 and who live outside of the city of atlanta may be eligible for a new $10,000 homestead exemption providing relief for the fulton.

Fulton County Homestead Exemption Form Revocable Trust, You are able to make homestead exemption filings as well as business, aircraft and marine personal property returns using our online filing portal. Homestead exemption applications for senior or disabled citizens must be filed with the finance department by april 1 of a given tax year at 2006 heritage walk, milton, ga.

Fillable Residence Homestead Exemption Application Form printable pdf, Fulton county homeowners who are over age 65 and who live outside of the city of atlanta may be eligible for a new $10,000 homestead exemption providing relief for the fulton county schools portion of property taxes. Homestead exemption application for senior citizens, disabled persons and surviving spouses.